As Delta-8 leads the way, another intoxicating cannabis product is making the rounds: Delta-9 gummies. A recent headline from from the Dallas Observer, for example, reads: “Move Aside, Delta-8, Texas Smoke Shops Are Filling Up with Legal Delta-9 THC Products.” One vendor says “Delta-9 THC gummies are mildly psychoactive and completely legal in the US.”

How so? According to HeraldNet:

So how is it possible to make 10mg delta-9 THC gummies that are only 0.3% THC by dry weight volume? It’s simple. Here’s how the loophole works its magic.

Make the gummies a little bigger and voila! To make it a bit easier, the 0.3% THC is approximately 3mg/g of THC in any given product.

If the total gummy weighs about 4 grams, then you can legally squeeze in nearly 12 mg of THC and still be in compliance with the 2018 Hemp Farm Bill.

In short, the idea underlying this new trend is that “hemp-derived products” containing less than 0.3% THC by dry weight are “hemp,” by way of the 2018 Farm Bill.

Now let’s destroy it.

The 2018 Farm Bill amended the Controlled Substances Act in two relevant ways. First, it removed anything that is “hemp” from the statutory definition of “marihuana.” Second, it removed “tetrahydrocannabinols in hemp” from the definition of tetrahydrocannabinols. In turn, the statutory definition of hemp is:

The term “hemp” means the plant Cannabis sativa L. and any part of that plant, including the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers, whether growing or not, with a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis.

Because of these amendments, any part of the cannabis plant with less than 0.3 percent on a dry weight basis is no longer controlled by the CSA. For more background, Rod Kight published a useful article, which I generally agree with.1

By my read, the claim advanced in favor of Delta 9 THC gummies is slightly different from what the 2018 Farm Bill actually did. The claim is that as long as a finished product clocks in at less than 0.3 percent THC on a dry weight basis and the THC is hemp-derived material,2 the finished product is legal.

Let me explain why this is problematic by looking at the statute. “Hemp” means (1) the plant Cannabis sativa L. and (2) any part of that plant, including the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers. The hemp exclusion from “marihuana” in 21 U.S.C. § 802(16) does not make any product that has less than 0.3% THC by dry weight “hemp,” including a hemp extract mixed with other non-cannabis material. It makes cannabis derived material having less than 0.3% THC by dry weight “hemp.”

Here is how the statute, 21 U.S.C. § 802(16), works in a handy flowchart I made:

This actually leads to some counterintuitive conclusions. For example, seeds or tissue culture sourced from an illegal “marihuana” plant might themselves be uncontrolled “hemp” because the seed or tissue material doesn’t have more than .3% THC by dry weight.

Importantly, when making this “hemp” vs. “marijuana” determination, only the cannabis extract and any part of the gummy that is sourced or derived from cannabis counts. The other stuff (e.g., Blue Raspberry flavoring or sugar) isn’t part of the math in determining whether the product contains legal “hemp” or illegal marihuana (in the form of THC extract):

According to their ingredients, these “hemp-derived” gummies contain Sugar, Apple Pectin, Sodium Citrate, Water, Corn Syrup, Coconut Oil, Flavoring, Color, Citric Acid, Lecithin. None come from hemp, so they don’t get factored into the denominator.

The prefatory text to Schedule I(c) of the Controlled Substances Act removes all doubt: “[u]nless specifically excepted or unless listed in another schedule, any material, compound, mixture, or preparation, which contains any quantity of the following hallucinogenic substances” is a Schedule I substance. A 12 mg THC extract infused into a 4-gram gummy consisting of non-cannabis isn’t a “hemp” gummy. It is a “material,” “mixture,” or “preparation” containing “marihuana,” which is a Schedule I controlled substance.

Let’s walk through a concrete example:

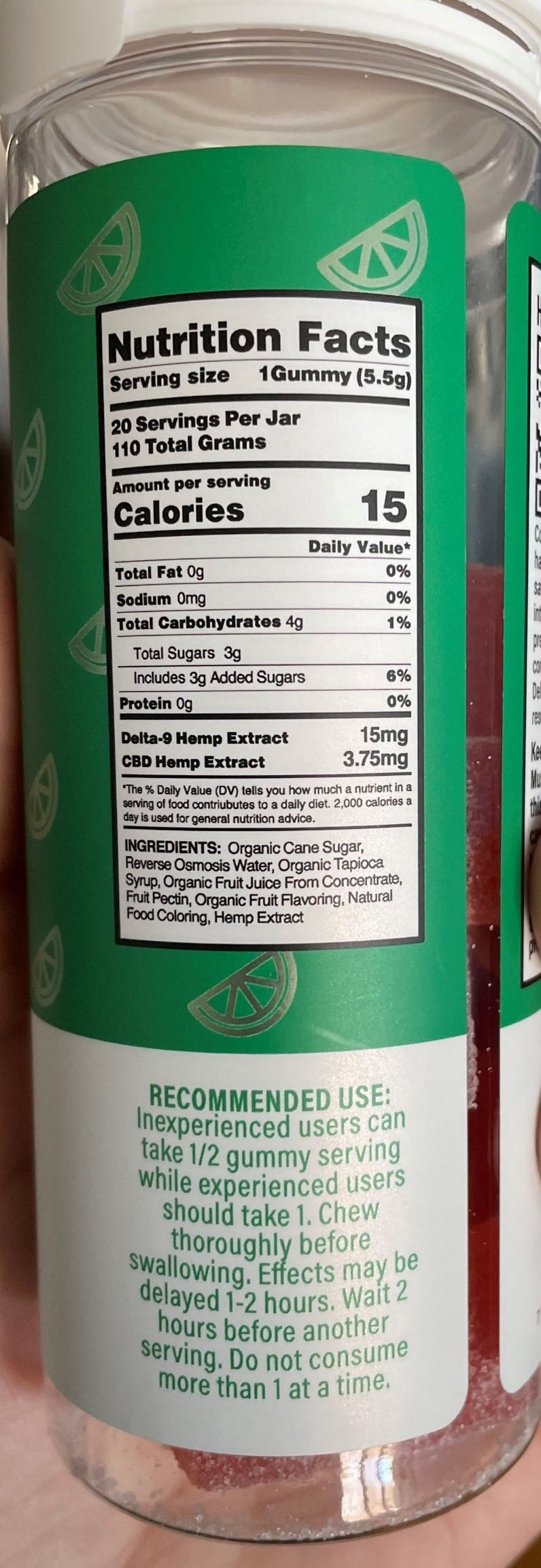

The above product is a 5.5g gummy that has 3g of “Added Sugars,” such as cane sugar, as seen in the ingredients. That leaves, at most, 2.5g of cannabis derived material. Could this product contain “hemp”? Probably not. Because 15 mg out of 2.5g, even without dehydrating the gummy to account for dry weight, is .6%, more than twice the legal limit. Most likely, this is a Schedule I mixture.

Put simply, one can’t just take a controlled substance, mix it with a non-controlled substance, and obtain a non-controlled mixture. If that is what the vendors are claiming, the “legal loophole” does not hold up. The CSA doesn’t work that way, and what is being created and sold is contraband.

This is not to say no finished product can have intoxicating levels of THC and be legal. A 4-gram gummy made from 95% hemp that has only 4 mg of THC might be legal if the cannabis based materials net out at .3% dry weight THC, which is hemp. And you can eat a few gummies too. Mixing a legal hemp extract with sugar and flavoring is just fine. But a non-hemp based gummy or brownie infused with a THC extract is not uncontrolled. It is a “marihuana” mixture.

To illustrate the analysis, in the diagram below, to determine if the product is controlled, the relevant .3% dry weight THC comparison is not the total material or product (blue) to THC (red), but the cannabis extract (green) to THC (red):

In short, are hemp-derived products that contain no more than 0.3 percent delta-9 THC federally controlled substances even if they cause intoxicating effects? The answer based on a close textual reading of the CSA is that it depends what you mean by “hemp-derived product.” Gummies where the cannabis-derived material exceeds .3 percent THC dry weight are Schedule I “marihuana” mixtures, and those that sell these mixtures (let alone openly) put themselves in legal jeopardy. If the cannabis-derived material in the product does not exceed .3 percent THC dry weight, then you are probably in the clear.

[EDIT: The original version of this essay reflected a disagreement over “math.” Rod has since updated his article, and there doesn’t appear to be much of a disagreement anymore— and if there is, it is minor. I certainly agree with Rod’s bottom-line point: whether a final natural-THC product is intoxicating is irrelevant.]

To the extent one asserts that high-THC extract sourced from hemp is not controlled, I disagree with that too. A natural THC extract that is derived or sourced from non-excluded parts of the cannabis plant is controlled as “marihuana,” unless that cannabis extract has less than .3% THC dry weight. This follows from the statutory definition of “marihuana” in the flow chart. The court in HIA II (from 2004) did not conclude otherwise, but simply held that the listing of THC in the schedules included only synthetic THC, not naturally occurring THC.

That a THC extract may be derived or extracted from a legal hemp is immaterial, because the hemp exclusion from marijuana is not based on a “source rule.” This conclusion not only follows from the statutory text, but also common sense. If all THC extract sourced from hemp is uncontrolled, regardless of THC potency, why bother with the façade of a finished product having less than .3% dry weight THC? If the THC extract isn’t controlled, then the final composition doesn’t matter.

Matt, excellent article.

I've long-believed D9 in gummies was legal hemp so long as the extract came from hemp and the D9 did not exceed 0.3% on a dry-weight basis. In fact, I may have been the first client of Rod's to ask if I could do this in late 2019.

You've put this in doubt and I feel relieved that I do not offer any products of this nature.

However, if you have the time...

Does this debate not ultimately *boil down* to WIPHE?

The snippet Rod shared from the FDA: “recommends that sponsors, investigators, or applicants evaluating intermediates or finished products that contain cannabis or cannabis derived compounds base the calculation of delta-9 THC percentage on the composition of the formulation with the amount of water removed, including any water that may be contained in excipients.”

The FDA's language suggests that only water weight be deducted from the denominator for the purposes of determining % D9 content. Not that % D9 content should be measured as a % of cannabis extract used in the formula.

Perhaps it's different here though because of the CSA & Farm Bill, which I believe you are contending.

But then you are also essentially saying dilution is NOT the solution [to WIPHE]. Whether the diluent is hemp-derived or not. Because the CSA suggests these compounds are to be treated separately. The key operator being 'or' in 'material, compound, mixture, or preparation', so 'mixture' does not mean that we can mix a compliant hemp extract with a non-compliant extract and have a compliant one.

In which case, virtually all full-spectrum CBD products are illegal under the same argument you are making here. Even if they were diluted to compliance with other hemp-derived material like broad spectrum distillate, the non-hemp extract (under the CSA) was still a separate ingredient at some point in the process.

If it is in fact ok to dilute full spectrum CBD extract with MCT oil to get it to <0.3% D9 by dry-weight, as has been the consensus view from the beginning to my knowledge, then the dilution of mother liquor or converted D9 by gummy ingredients (other than water) must also be legal, too, right?

But if you contend that only isolates, broad spec distillates (non-diluted), and Delta-8 are legal as a final product or as an ingredient, then I must ask how your argument applies to crude oil as a material / compound in the process of making isolates, broad-spec distillates, and delta-8.

So now, perhaps only CBD flower is legal. But I suppose you will say that in making isolate, crude oil is stripped of non-compliant molecules, and it is not an ingredient.

The consensus has always been "if D9 does not represent more than 0.3% D9 of your final, consumer product, then your final, consumer product is legal." This is what has been communicated by agencies, and this is how the rules have been enforced. To my knowledge.

A full-spectrum CBD oil tested for legal compliance by an agency would be tested in the state that it has sold. I am not aware of any circumstance where they have gone beyond that to figure out if the inputs were all legal / compliant on their own.

Surely I am off-base here and should stop playing backseat-lawyer. Or maybe the rules / law is that grey.